get started

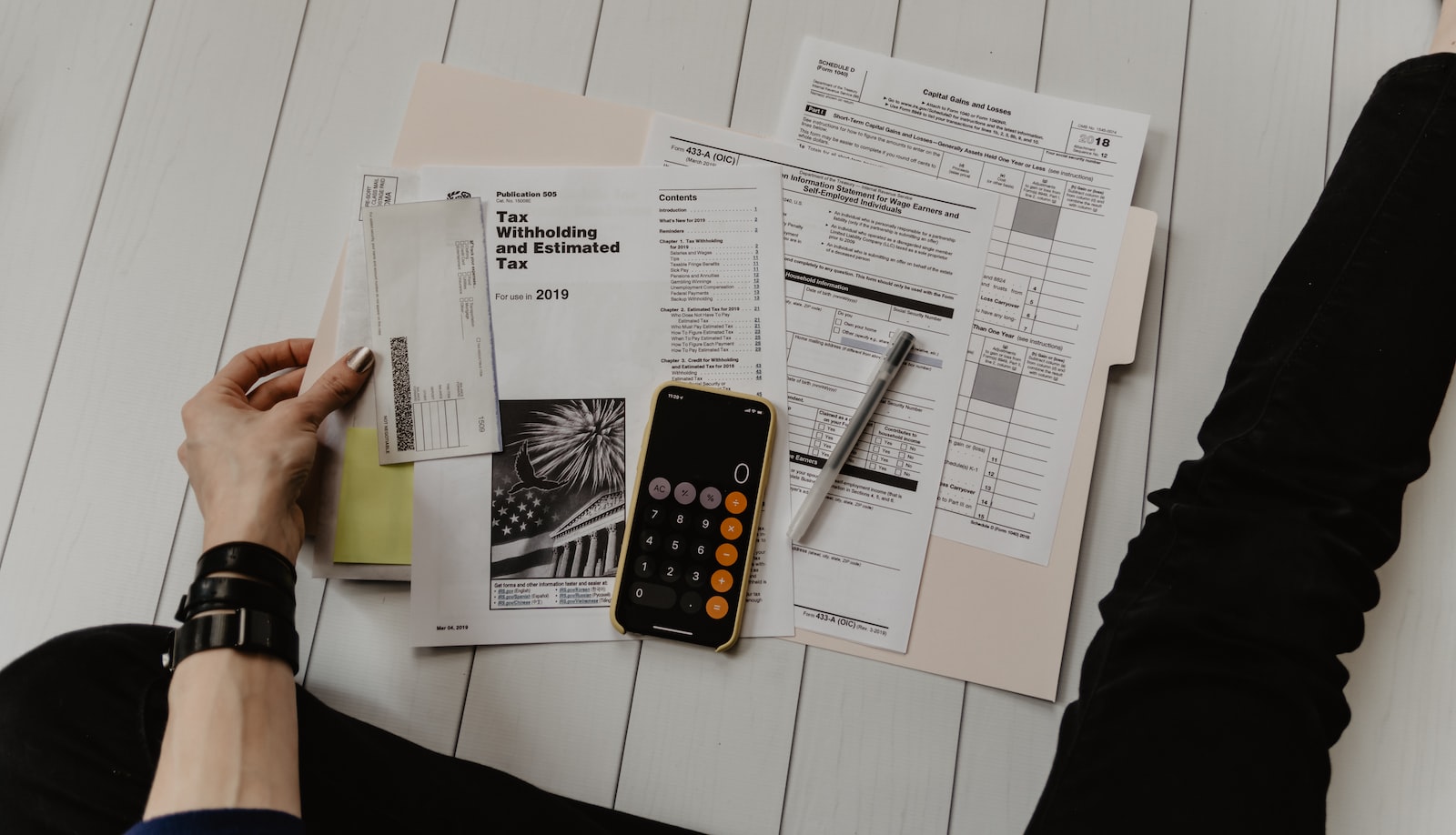

How does the tax filing process work?

Set a virtual meeting with us today.

STEP 1: Gather documents and complete tax organizer

Please fill tax organizer to help gather the documents necessary to prepare your federal and/or state tax returns. The documents can be transferred through our secure portal.

STEP 2: Schedule Interview

An email will be sent to you to schedule an interview, whether in-person (if you live in El Salvador) or virtually (if you do not live in El Salvador), to make sure you share all the necessary information to start preparing your tax returns.

STEP 3: Prepare Tax Return

We will prepare your tax returns.

STEP 4: Review Tax Return

We completed a draft of tax returns and these returns will be sent to you for your review. If you agree with the returns, please sign off on any required electronic filing forms for any relevant tax authority so your tax returns can be electronically filed.

In order to receive your draft tax returns, you should have paid any related fees.

STEP 5: Submit Tax Return Electronically

We successfully submitted your tax returns electronically. We will send you copies of your final tax returns including electronic filing confirmations.